S corp payroll tax calculator

Sign Up and Try for Free Today. Federal State and Local Taxes All Included.

Employer Payroll Tax Calculator Incfile Com

This calculator helps you estimate your potential savings.

. Free Unbiased Reviews Top Picks. S-Corp or LLC making 2553 election. Ad Compare This Years Top 5 Free Payroll Software.

Why use QuickBooks Payroll for S corporations. QuickBooks Online Payroll is the No. Get Started for Free.

Check each option youd like to calculate for. Based Specialists Who Know You Your Business by Name. Taxes Paid Filed - 100 Guarantee.

No Need to Transfer Your Old Payroll Data into the New Year. Calculate payroll and taxes Once theyve determined their salary S corporation owners divide the annual figure by the number of pay periods monthly quarterly etc. Ad Roll by ADP Runs Payroll in All 50 States.

Compare Side-by-Side the Best Payroll Service for Your Business. Estimated Local Business tax. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Ad Payroll So Easy You Can Set It Up Run It Yourself. We are not the biggest. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

For example if your one-person S corporation makes 200000 in profit and a. Annual cost of administering a payroll. The result is then used as.

Calculating the employers payroll tax burden Your corporation pays a 765 Social Security and Medicare payroll tax. Calculate taxes and net payroll Like with payroll for standard employees S Corps must calculate and deduct the following from an employee owners wages. If your S corporation pays you payroll of 10000 a quarter.

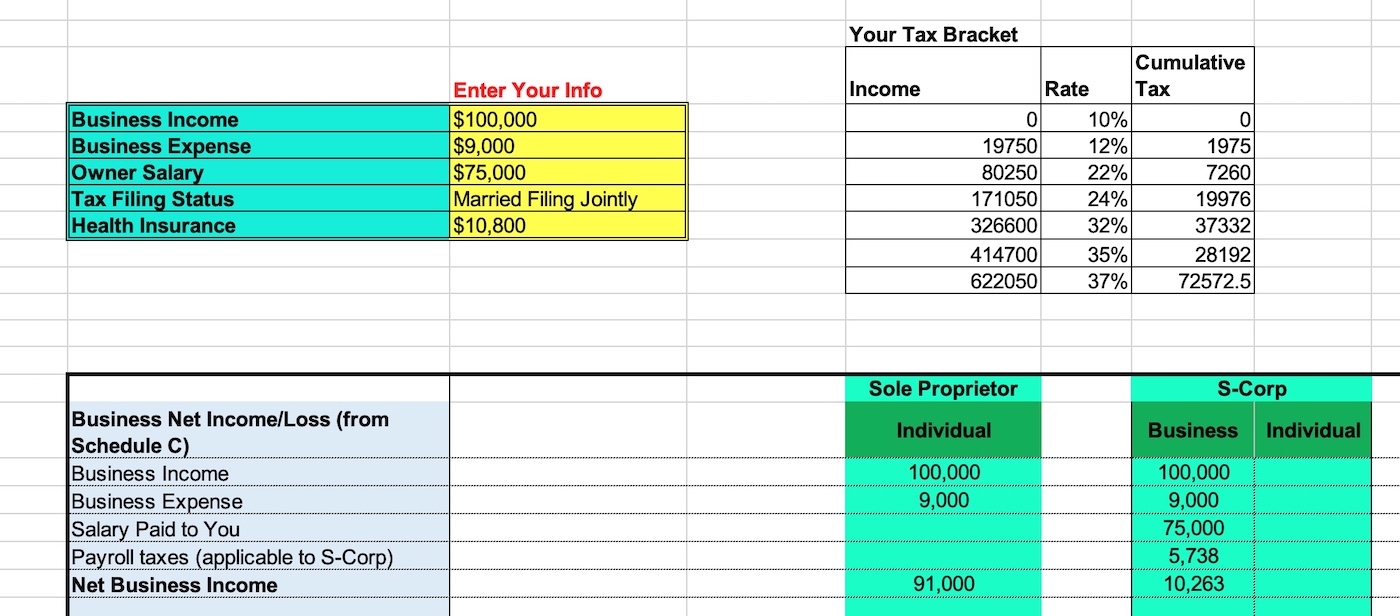

Get Started With ADP Payroll. How to calculate annual income. Forming an S-corporation can help save taxes.

For example if an employee earns 1500. Ad Process Payroll Faster Easier With ADP Payroll. C-Corp or LLC making 8832 election.

As a sole proprietor you would pay self-employment tax on the full 90000 90000 x 153 13770. Ad Payroll So Easy You Can Set It Up Run It Yourself. As we explain below you may be able to reduce your tax bills by creating an S corporation for your business.

Ad Process Payroll Faster Easier With ADP Payroll. Discover ADP Payroll Benefits Insurance Time Talent HR More. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Total first year cost of S-Corp. But as an S corporation you would only owe self-employment tax on the 60000 in. Tax Savings Calculator Page Forming an S-Corporation instead of a Sole Proprietorship You may be able to reduce self-employmentpayroll taxes by being taxed as an S-Corporation.

Payroll Tax Calculator Our payroll tax calculator is designed to help you quickly calculate payroll deductions and withholdings for your employees. Get Started With ADP Payroll. Ad Start Afresh in 2022.

All Fields Required Employer Paid Payroll Tax Calculator With our payroll tax calculator you can quickly calculate payroll deductions and withholdings and thats just the start. Partnership Sole Proprietorship LLC. Taxes Paid Filed - 100 Guarantee.

From the authors of Limited Liability Companies for Dummies. It only takes a. 1 payroll provider for small businesses and its easy to see why1 Access all your S corp payroll tax and.

Focus On Doing What You Love--Running Your Small Business. Ad Payroll Made Easy. Features That Benefit Every Business.

Annual state LLC S-Corp registration fees. With this calculator its easier to plan for the.

How To Do Payroll For Single Member S Corporation The Accountants For Creatives Payroll Payroll Accounting Small Business Finance

S Corporation Tax Calculator

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

S Corporation Tax Calculator

Cash Management Payroll 101 What Every Small Small Business Community Cash Management Community Business Payroll

Organize Small Business Taxes Plus Free Printables Small Business Tax Business Tax Business Organization

S Corp Payroll Taxes Requirements How To Calculate More

S3solutions Can Help You Claim Back Any Overpaid Taxes In Bangalore India Http Www S3solutions In Indirect Tax Income Tax Tax Services

October 15 Extended Tax Filing Deadline Tax Time Filing Taxes Tax Season

S Corporation Tax Calculator

Sole Proprietorship Vs S Corp Tax Spreadsheet For Internet Publisher And Youtuber Which Will Save More Tax Money Techwalls

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

Who Hates Taxes The Answer Isn T What You Think Administracion Servicio A Clientes Negocios Internacionales

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

S Corporation Tax Calculator

Pin On Starting A Llc For Your Business

Payroll Tax Calculator For Employers Gusto